Bank cards and digital payments

The display case shows a selection of the coins and banknotes issued during the period 1874-2017. At the start of the period, Sweden and Denmark had just formed the Scandinavian Monetary Union and Norway joined the following year.

The gold standard

The idea of pegging the currency to gold was mainly based on the idea of stability and simplified conditions for international trade. By pegging currencies to something with a relatively stable value like gold, it was widely believed that this could be achieved. This gave countries fixed exchange rates.

England was a model internationally, as the pound was pegged to gold for almost the entire period between 1717 and 1914. Most countries had long pegged their currency to some form of metal, usually silver. Bimetallism also occurred, as in the case of Sweden, where the currency was periodically pegged to both silver and copper, or, as in the case of France, to gold and silver.

Linking the currency to gold alone would hardly have been possible before the discovery of large gold deposits in America, Australia and Canada in the 19th century. Before then, the amount of gold in the world was too small. Another important component was the emergence and development of central banks and their functions. The idea was that an economy based on the value of gold would be sufficient to resolve any tensions between the economies of different countries. In reality, central banks came to play an important role when problems arose. They were able to help each other, and they intervened more than might have been recognised.

The period between 1873 and the outbreak of the First World War in 1914 saw a relatively free flow of capital to and from Sweden, combined with a fixed exchange rate between the krona and gold. This led to favourable economic development for the country. Low inflation and relatively low interest rates characterised this period.

Most countries were forced to leave the gold standard because of the First World War, including the Scandinavian countries. Inflation increased at different rates in the three countries and the Scandinavian Monetary Union effectively stopped functioning in the 1920s. Nevertheless, it was not until 1972 that it formally ended. The krona denomination still exists in Sweden, Norway and Denmark.

During the First World War, there was soon a shortage of copper, among other things. The price became so high that it was not possible to mint bronze coins without loss. The solution was to issue iron coins instead. Minting iron coins also saved time, as bronze coins required melting the metals before minting. Iron, on the other hand, could be ordered in the form of rolled sheets of the right thickness.

After the First World War, there was a strong desire to return to the gold standard, which happened in most places. In Sweden, the gold standard was reintroduced as early as 1922, although it was not formalised until 1924.

Precious metals disappear from coins

Apart from Swedish coins and tokens made of copper or bronze, the main coins have historically been made of either gold or silver. Having a certain amount of precious metal in the coins reflects our desire for the coins to have an intrinsic value that is not solely dependent on our trust in the coin issuer. However, during the 20th century, both gold and silver gradually disappeared from our coins.

Gold disappeared first and the last Swedish gold coins to be minted were 20 kronor in 1925 during the reign of King Gustav V. One-krona coins retained a relatively high silver content (80%) until 1942, when the amount of silver was halved and the weight dropped slightly. The last one-krona coins containing silver were issued in 1968. However, silver five-krona coins were minted as late as 1971.

In 1950, the last 1-öre coin was struck. After that, the minting of the 5 and 25 öre coins ceased in 1984, the 10 öre in 1991 and finally the 50 öre in 2009. Between 1962 and 1972 there was a transition from silver to copper-nickel.

Since 1968, Swedish gold and silver coins have only been minted as jubilee or commemorative coins, most recently for the wedding of Crown Princess Victoria and Daniel Westling in 2010. The one- and five-krona coins were minted in an alloy of copper and nickel between 1968 and 2013.

The latest series of coins issued in 2016 includes the 10-krona, the 5-krona in aluminium bronze, the 2-krona, which has returned after a hiatus since 1971, and the 1-krona. The latter have both changed from being silver-coloured coins to the same colour as the lowest öre coins. The colour of the 5-krona is reminiscent of the first 10- and 5-krona coins issued in gold during the Scandinavian Monetary Union. After 2007, the production of coins within Sweden ceased after more than 1000 years. Since 2008, it has been produced elsewhere in Europe.

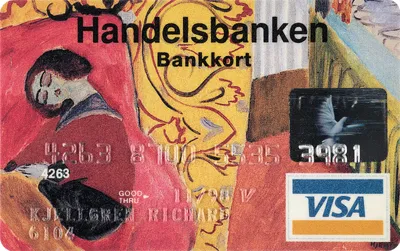

Payment cards and electronic money

The share of people who paid for their last purchase with cash in Sweden fell from 39% to 9% between 2009 and 2020. The total share of money available in the form of cash is now about 1.2%. The rest of our money is made up of balances that are mainly stored electronically in one way or another.

The evolution of the last sixty years speaks volumes. The money we use today is no longer in our wallets in the form of notes and coins. Instead, we keep our money in a bank account to which our bank card is linked. In turn, all communication between banks is fully electronic and many banks have stopped handling cash altogether. Today, if you want to withdraw cash, you have to do so via the few ATMs that remain, or possibly at the checkout in a shop.

Today, we don’t even need to carry a bank card at all times. We can just as easily use our mobile phones for most transactions, either using Swish, Apple Pay, Samsung Pay, Google Wallet or Swedbank wallet. When Swedes shop in stores, 45% pay by debit card, 27% by credit card, 14% by digital wallet, 3% by invoice and 8% used Swish. 3% paid by other means. For online purchases, 12% used credit cards, 13% debit cards, 12% direct from account, 29% swish, Vips and mobile pay, 21% via invoice, and 7% used digital wallet (statistics from December 2022).

20 kronor, Stockholm, Oscar II, 1900

10 kronor, Stockholm, Oscar II, 1901

5 kronor, Stockholm, Oscar II, 1899

20 kronor, Stockholm, Gustaf V, 1925

5 kronor, Stockholm, Gustaf V, 1920

4000 kronor, Eskilstuna, Carl XVI Gustaf, 2010

10 kronor, Eskilstuna, Carl XVI Gustaf, 1991

5 kronor, Carl XVI Gustaf, 2016

2 kronor, Stockholm, Oscar II, 1907

1 krona, Stockholm, Oscar II, 1875

50 öre, Stockholm, Oscar II, 1907

25 öre, Stockholm, Oscar II, 1907

10 öre, Stockholm, Oscar II, 1881

2 kronor, Stockholm, Gustaf V, 1942

1 krona, Stockholm, Gustaf V, 1942

50 öre, Stockholm, Gustaf V, 1911

25 öre, Stockholm, Gustaf V, 1940

10 öre, Stockholm, Gustaf V, 1942

2 kronor, Stockholm, Gustaf VI Adolf, 1959

1 krona, Stockholm, Gustaf VI Adolf, 1968

50 öre, Stockholm, Gustaf VI Adolf, 1956

25 öre, Stockholm, Gustaf VI Adolf, 1956

10 öre, Stockholm, Gustaf VI Adolf, 1956

5 kronor, Stockholm, Gustaf VI Adolf, 1972

50 öre, Stockholm, Gustaf VI Adolf, 1968

25 öre, Stockholm, Gustaf VI Adolf, 1970

10 öre, Stockholm, Gustaf VI Adolf, 1972

5 kronor, Eskilstuna, Carl XVI Gustaf, 1976

1 krona, Eskilstuna, Carl XVI Gustaf, 1976

1 krona, Finland, Carl XVI Gustaf, 2009

50 öre, Eskilstuna, Carl XVI Gustaf, 1976

25 öre, Eskilstuna, Carl XVI Gustaf, 1983

10 öre, Eskilstuna, Carl XVI Gustaf, 1991

5 öre, Stockholm, Oscar II, 1874

2 öre, Stockholm, Oscar II, 1906

1 öre, Stockholm, Oscar II, 1874

5 öre, Stockholm, Gustaf V, 1917

2 öre, Stockholm, Gustaf V, 1942

1 öre, Stockholm, Gustaf V, 1917

5 öre, Stockholm, Gustaf V, 1939

2 öre, Stockholm, Gustaf V, 1942

1 öre, Stockholm, Gustaf V, 1939

5 öre, Stockholm, Gustaf VI Adolf, 1961

2 öre, Stockholm, Gustaf VI Adolf, 1961

1 öre, Stockholm, Gustaf VI Adolf, 1966

5 öre, Stockholm, Gustaf VI Adolf, 1972

5 öre, Eskilstuna, Carl XVI Gustaf, 1981

50 öre, Eskilstuna, Carl XVI Gustaf, 1995

2 kronor, Carl XVI Gustaf, 2016

1 krona, Carl XVI Gustaf, 2016

1 krona, Tumba, Sveriges riksbank, 1874

5 kronor, Tumba, Sveriges riksbank, 1891

10 000 kronor, Tumba, Sveriges riksbank, 1958

5 kronor, Tumba, Jorpes, Albert, 1948

100 kronor, Tumba, Sveriges riksbank, 2015

10 kronor, Tumba, Sveriges riksbank, 1968

Handelsbanken, 1995

Stockholm, Nordiska Kompaniet AB, 1920

500 kronor, Tumba, Sveriges riksbank, 1985

100 kronor, Tumba, Sveriges riksbank, 1986

1000 kronor, Tumba, Sveriges riksbank, 2005